What is forex hedging & why do you need it?

Due to the known volatility of currency exchange rates, companies engaging in cross-border activities are exposed to the risk of unexpected shifts that might impact on their profit margins and disrupt financial stability.

Forex hedging is about managing risk

Forex hedging is a risk management strategy used by companies that are looking to protect themselves from adverse currency rate fluctuations. These fluctuations can lead to financial uncertainty, impacting a company's profitability and financial stability. Hedging helps companies mitigate these risks, ensuring that they can anticipate and manage their financial outcomes more effectively.

Making a risk management strategy provides a level of certainty, allowing your business to plan the budgets with greater predictability. This is crucial for managing cash flows, pricing products or services, and ensuring financial stability in an environment where currency values can be highly volatile.

Okoora, and the ABCM platform provides a dual solution –

- Professional consulting by our trading room experts – every company has a personal consultant that is familiar with the company’s activity and has a multi years' experience. The consultant will be suggesting to you a tailored suite solution, taking into consideration the company’s needs and the FX market position.

- Technical support – the ABCM platform allows your business to consolidate all import/export operations in one place, so you can track the past operations and plan the future operations to be planned ultimately while following the foreign exchange market. The platform contains a 'Dashboard' that will present you with an updated market risk analysis and will be the focal point of setting and monitoring your hedging.

There are different hedging solutions, each offering a unique approach to managing currency risk, for example:

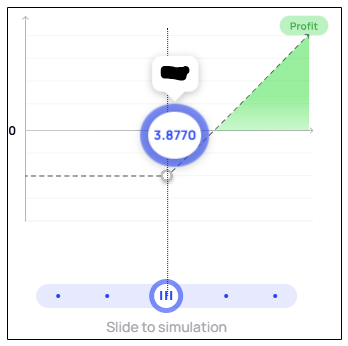

Safe Up/Down Hedging: Hedges involve setting a specific exchange target rate, allowing your business to ensure a rate that you consider favorable. This type of hedge can only benefit you as it serves as insurance that protects your funds.

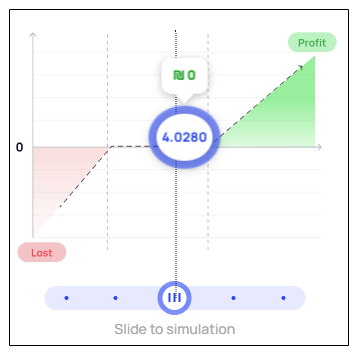

Range up/down - Hedges that allow your business to specify a range within which they are comfortable with the exchange rate fluctuation. This type of hedge is more flexible as it protects against rate movements that fall outside the specified range, while still allowing potential gains if the exchange rates are staying within the defined bounds.

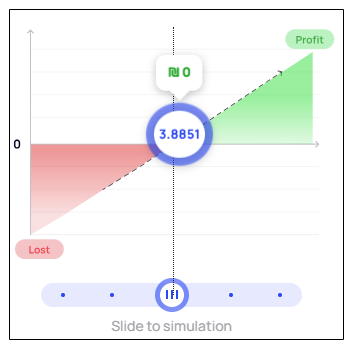

Lock & Up/Down - This hedging allows businesses to lock in exchange rates for future transactions, providing a valuable tool to hedge against the uncertainties of currency markets. By utilizing FX forward, you can make business plans with confidence, safeguard profit margins, and ensure financial stability in a volatile global FX market.

The benefits are multifaceted, ranging from enhanced risk mitigation to improved financial predictability, enabling businesses to focus on their core operations without the constant worry of adverse exchange rate fluctuations.

For more information regarding the latest version of the ABCM - visit our blog.