How does hedging forex with a forward differ from a cylinder?

For any business involved in cross-border transactions, it is crucial to protect the value of your currency holdings amid foreign exchange rate volatility. Two of the more basic hedging strategies available are buying a forward and buying a cylinder. While both can protect you from extreme price movements, there are some significant differences between them. This article will review what are forwards and cylinders and provide a detailed explanation of the differences between them aided by examples and diagrams.

What is a (forex) forward?

The first step in understanding basic ways to defend against exchange rate volatility is to grasp the concept of a forward. When a business agrees to a forward it accepts that it will purchase or sell a certain predetermined quantity of another currency in the future at a fixed exchange rate. This financial agreement is represented on the balance sheet of the business since it is a firm commitment to transact with company funds in the future. There is no minimum amount required to transact a forward, so small amount forward-transactions can be arranged. However, collateral usually must be offered by the forward buyer to ensure that they can meet the requirements of the future currency conversion transaction.

By locking in the foreign exchange rate of the desired currency in advance the company is eliminating the risk that the rate will travel further in an unfavorable direction causing significantly greater losses. However, the company is also eliminating the possibility that it will profit from a favorable movement in the exchange rate by the settlement date. Importantly, the purchase of a forward does not require the payment of a premium – since it is a notional transaction, meaning it only creates an actual cash flow on the settlement date. Nevertheless, the forward must be entered on a company’s balance sheet.

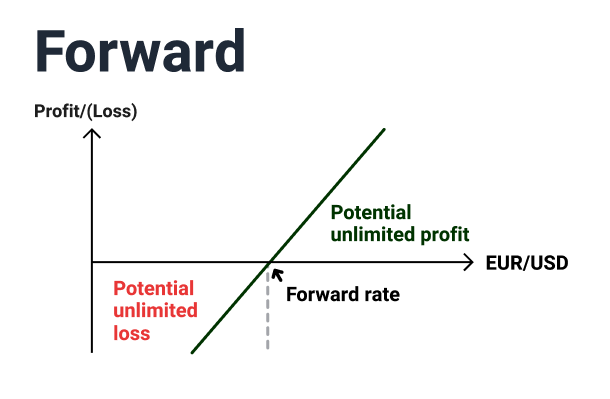

To explain it visually, below is a graph depicting what happens when someone buys a forward.

For the sake of example, let’s say a Spanish importer is buying dollars and selling euros. They could buy a forward with €1,000,000 at the rate of $1.05 to the euro to be settled in three months time from today. This would entitle the importer to $1,050,000 in May regardless of what the prevailing exchange rate is in the spot market on that day.

In practice, this means that if the exchange rate goes below $1.05 to the euro, the importer will have made a profit from their forward. If the exchange rate goes above $1.05 to the euro, the importer will have registered a loss on their forward.

Many small and medium-size businesses protect themselves from foreign currency risk exposure using forwards, probably because they are conceptually the simplest hedging instrument available. However, sometimes a cylinder strategy would be a better fit.

What are the key characteristics of a forward

- No cash premium required to hedge

- There are no minimum amounts for transacting a forward

- Collateral required for possible future liability

- Forwards are largely unregulated contracts between private parties

What is a cylinder in terms of hedging?

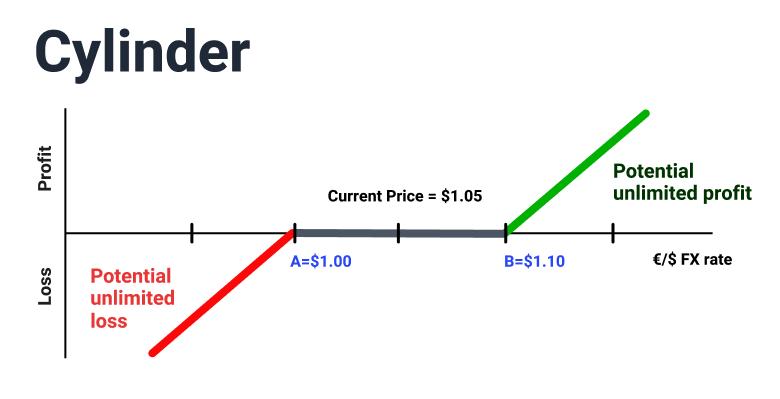

A cylinder in the forex market is a hedging strategy comprised of FX options - that usually does not require the payment of cash premium to create. Also known as a risk-reversal, collar or hedge wrapper, a cylinder is comprised by a balanced combination of a call-option and a put-option to build a symmetrical hedging strategy for customers. Below is a diagram showing what a cylinder or risk reversal looks likes:

For example, assume that the forex market spot price is currently at $1.05 to €1. A European importer could acquire a cylinder that gives them the obligation to sell euros to buy dollars at the price of $1.10 to €1. Meanwhile, they would simultaneously receive the right to buy dollars at the price of $1 to €1. This means when the dollar appreciates below $1.00 to the euro, the importer is protected from additional losses for the amount hedged because they can always exercise their right to buy dollars at $1 to €1. At the same time, if the dollar depreciates against the euro to above $1.10 to €1, the importer’s profits are limited by their agreement to exchange the hedged amount at the price of $1.10 to €1.

Typically, this strategy does not entail any premium costs due to the symmetry between the right to buy at a certain price and the obligation to sell at a different price.

Moreover, between the importer’s right to buy at $1 to €1 and their obligation to sell the euros at $1.10 to €1, the importer can lose or profit freely from the prevailing exchange rate on the spot market. This controlled exposure to risk is known as the “Range of Indifference.”

For the liability portion of the cylinder, the financial institution will usually require some form of collateral from the importer – in case the importer will be liable to pay the institution if the future spot rate will fall below $1.

What are the key characteristics of a cylinder

- Requires no net premium to be paid

- Like all option-based hedging strategies, has a minimum notional-amount required

- Enables risk taking within a (potentially) narrow band for profit and loss called the “Range of Indifference”

- Requires posting collateral, but to a lesser extent when compared with a forward

Main differences between a forward and a cylinder

So, what are the distinguishing differences between a forward and a cylinder option?

- The cylinder’s Range of Indifference provides controlled exposure to dynamic changes in the foreign exchange rate within a limited range, while all losses or profits on a forward are determined within reference to a specific set price

- Forwards have no minimum required amounts, cylinders do

What should you use: forward or cylinder?

This begs the question of when should you use a forward and when should you use a cylinder or risk reversal?

While we cannot provide financial advice on this blog, in general it will depend on your tolerance for risk. The more you are willing to risk in the open market (i.e. the size of your Range of Indifference), the more likely you will prefer a cylinder option. The more you prefer to base your financial calculations with reference to a single exchange rate, the easier you will find it to use forwards.

If you’d like to dive into the world of forex option strategies further, contact one of our experts to learn more.