Stay current on currencies relevant to your business

In a world where economic conditions and geopolitical events can swiftly affect currency values, staying informed about the foreign exchange market is not merely an advantage; it is a strategic imperative for businesses seeking to thrive in the global economy.

Staying updated about the foreign currency market, in today's globalized business landscape, is critical for any business that is exposed to multiple currencies. The dynamics of currency exchange rates can significantly impact a company's profitability, cost structure, and financial stability. Changes in foreign exchange rates could impact asset values, the cost of imported goods, and the competitiveness of exports.

As such, having real-time knowledge of the foreign currency market status is essential for informed decision-making. It enables businesses to hedge against potential risks, capitalize on favorable currency movements, and maintain financial stability.

This article is part of a series detailing and demonstrating the outstanding features of the new dashboard.

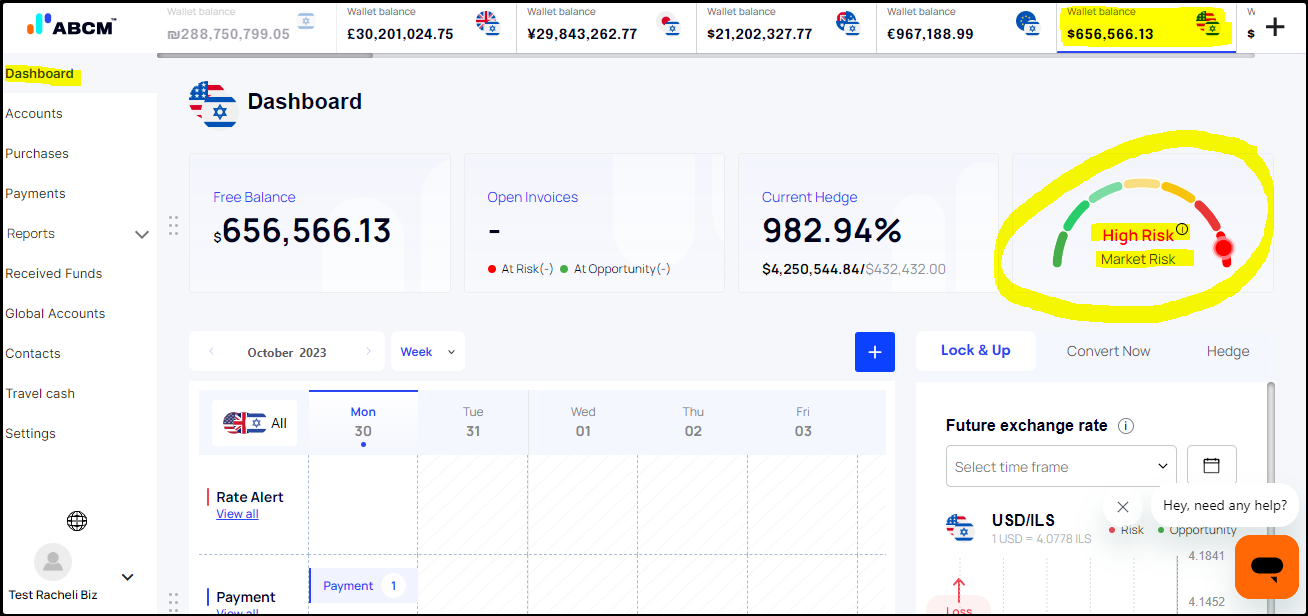

In this article, we will present the status features of the Dashboard that will help you to keep track of the exposure you have in your current or future business activities:

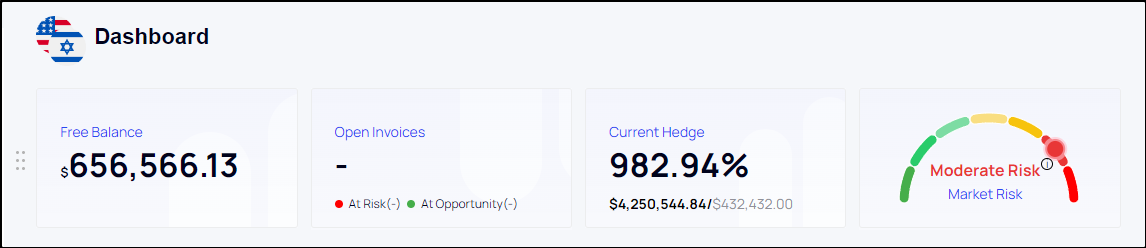

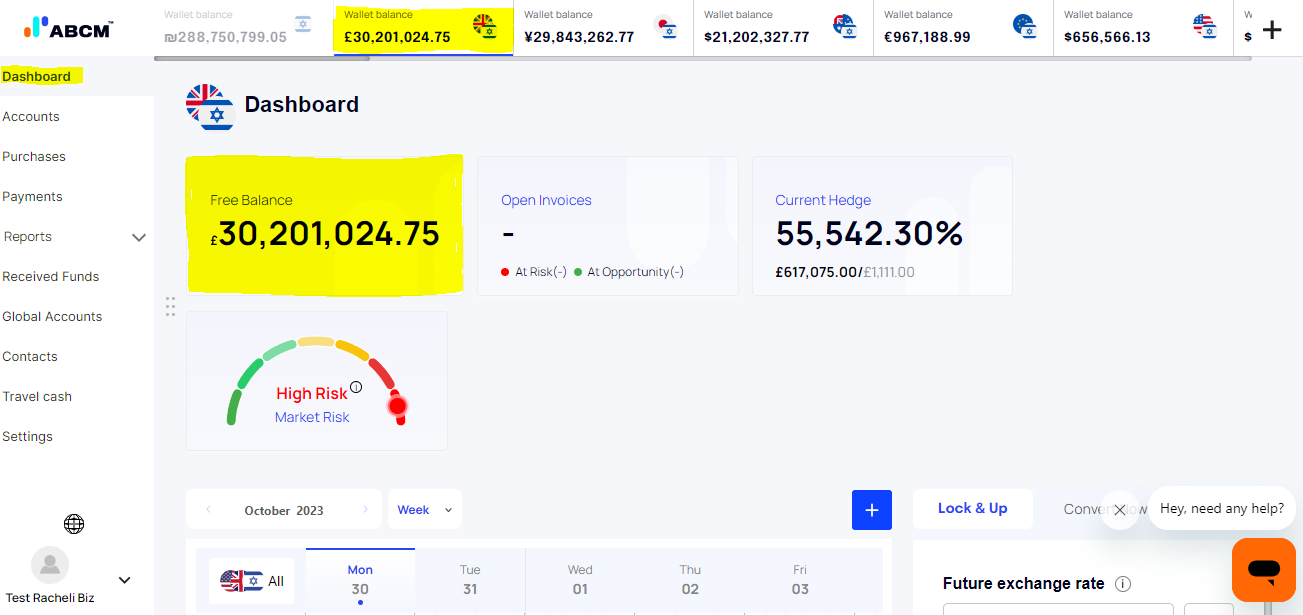

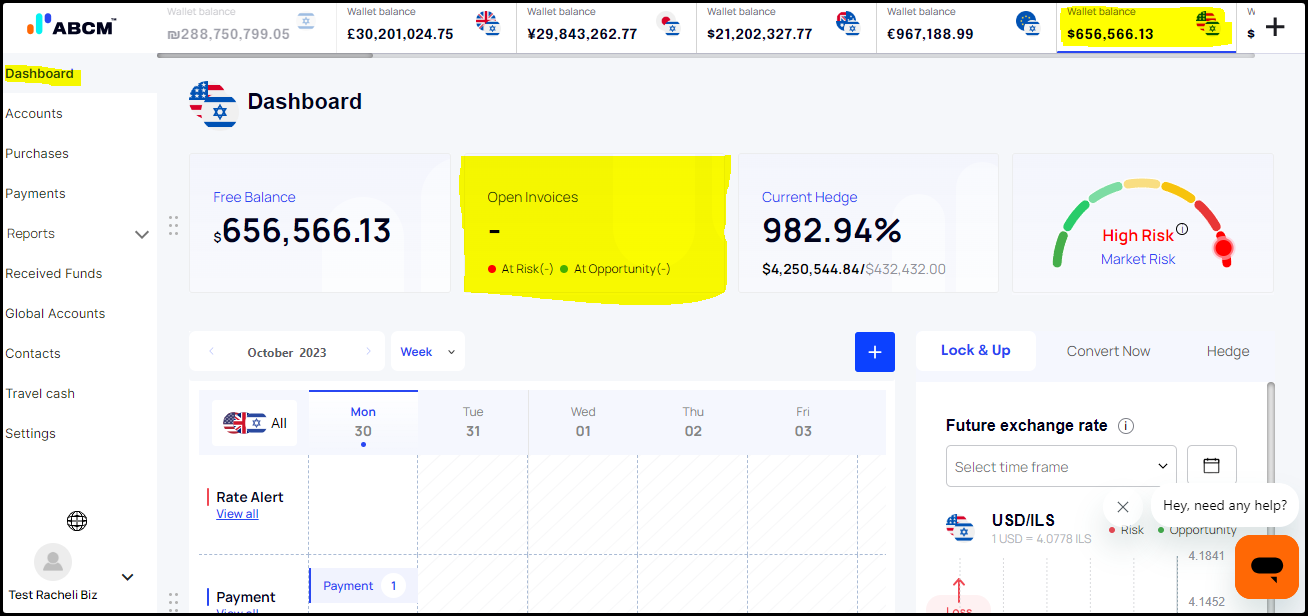

Free Balance – Displays the available balance at the moment.

The section refers to the amount of money or currency that a business has available in its account, which is not currently tied up in any pending transactions or obligations.

This term is used to help businesses manage their funds and understand the liquidity of their account.

The free balance section is a crucial management tool for businesses. It helps you to keep track of how much money you can readily access for your operational expenses, investments, or other financial commitments.

To access the Free Balance, click on Dashboard > relevant Wallet Balance and you will be displayed with the relevant dashboard of the foreign currency pair.

Open Invoices - This feature will display multi-currency invoices from international clients or suppliers. The feature allows your business to efficiently manage and keep track of any unpaid bills, providing real-time updates on their status, due dates, and amounts, all while considering the fluctuations in foreign exchange rates.

This tool not only improves financial visibility and management but also gives your company the ability to decide when and how to pay bills or, on the other hand, follow up on past-due payments. It empowers businesses to mitigate currency-related risks and streamline their financial operations, which is indispensable in today's globalized market.

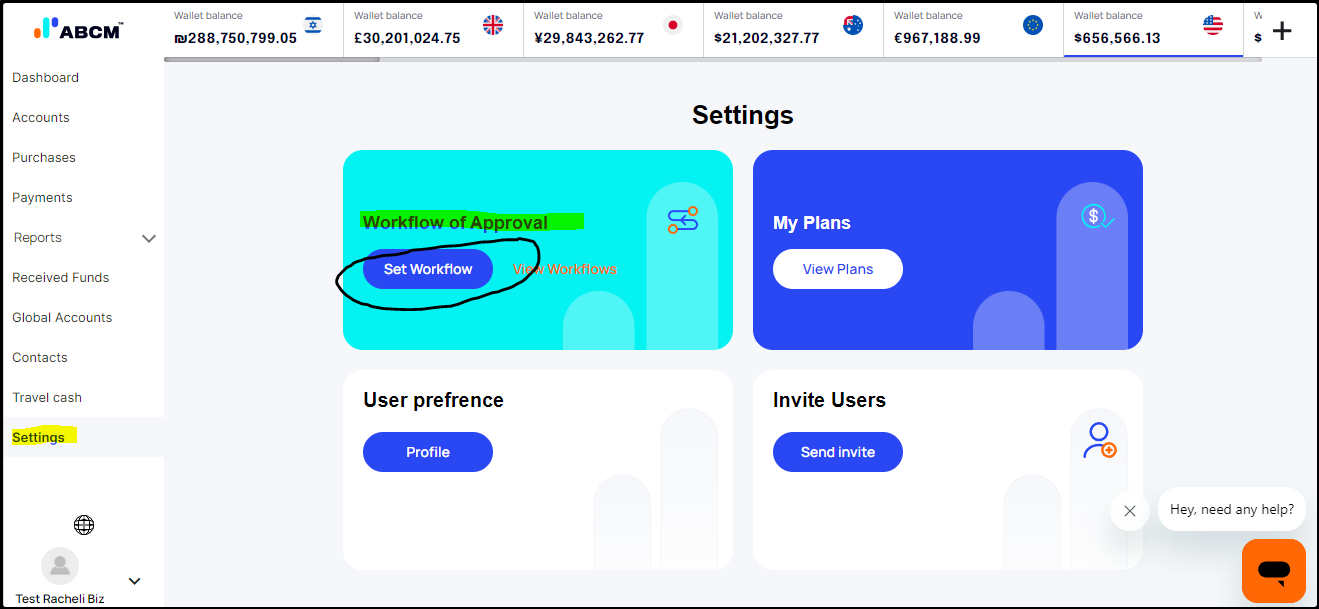

To benefit from the Open Invoices, you will need to set a few things first:

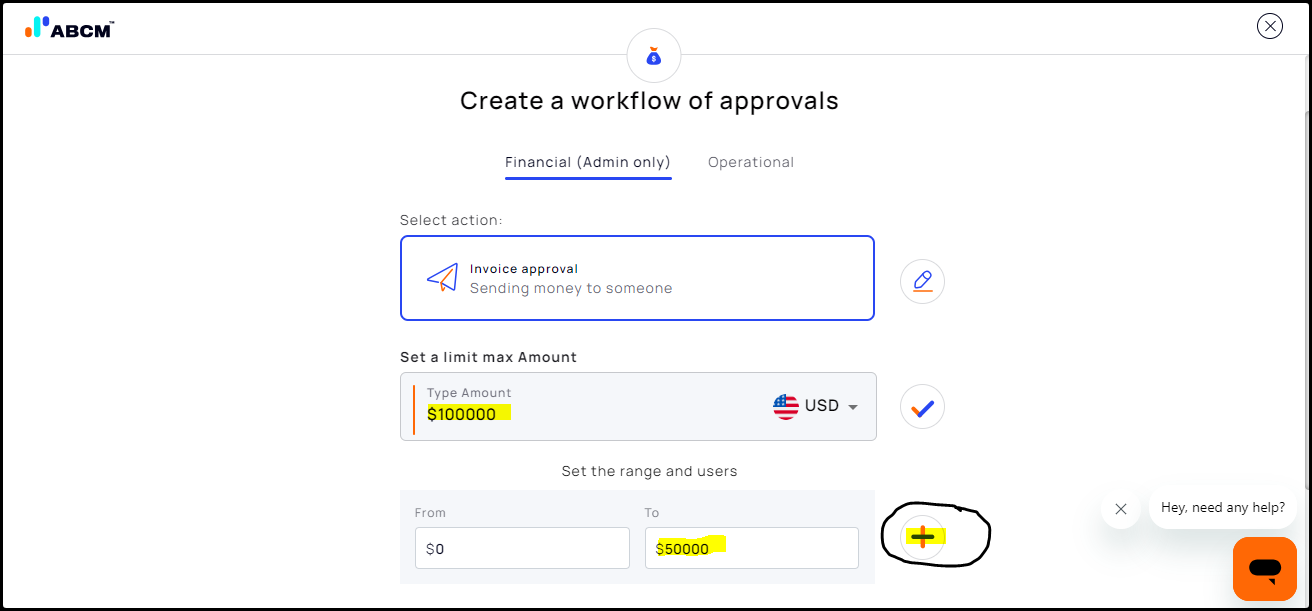

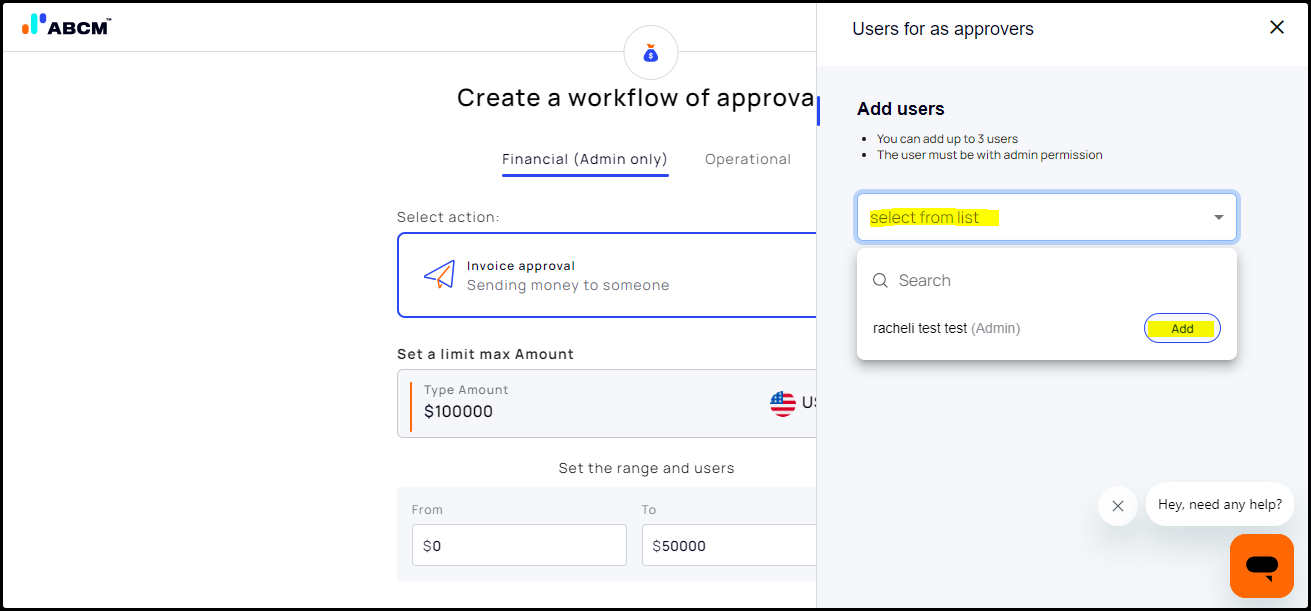

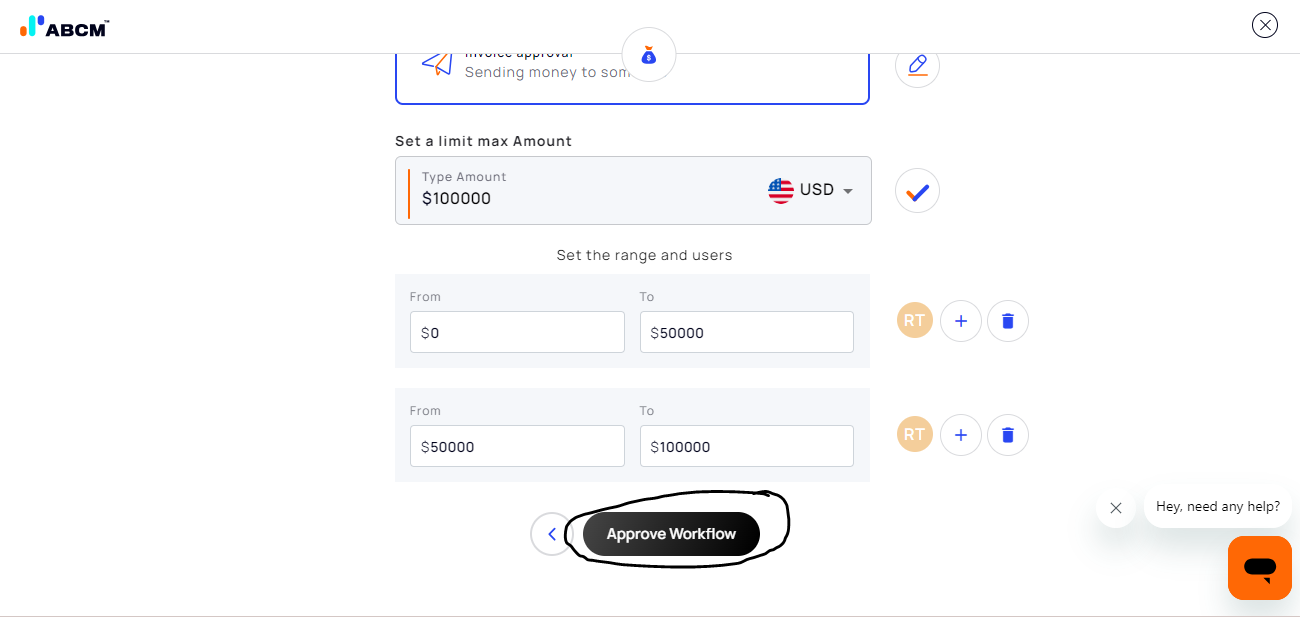

- Set your Workflow of Approval by going to Settings > Set Workflow

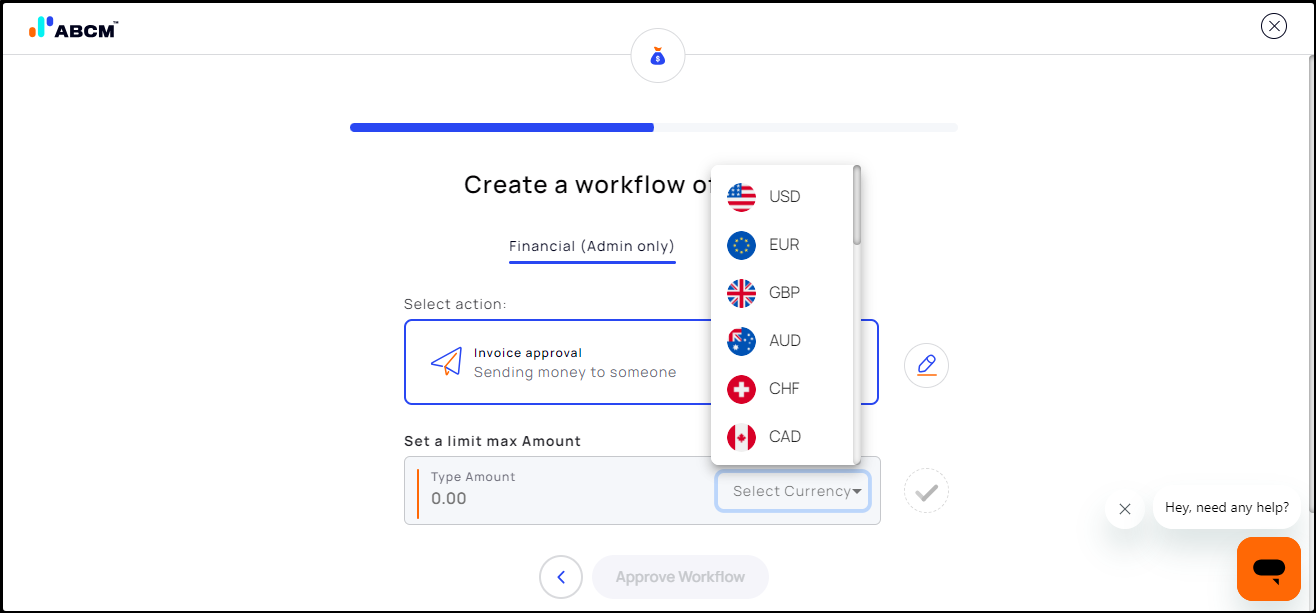

In the Invoice approval: set a maximum invoice amount

Define which user will approve the invoice up to a specific amount.

Click on "Approve Workflow"

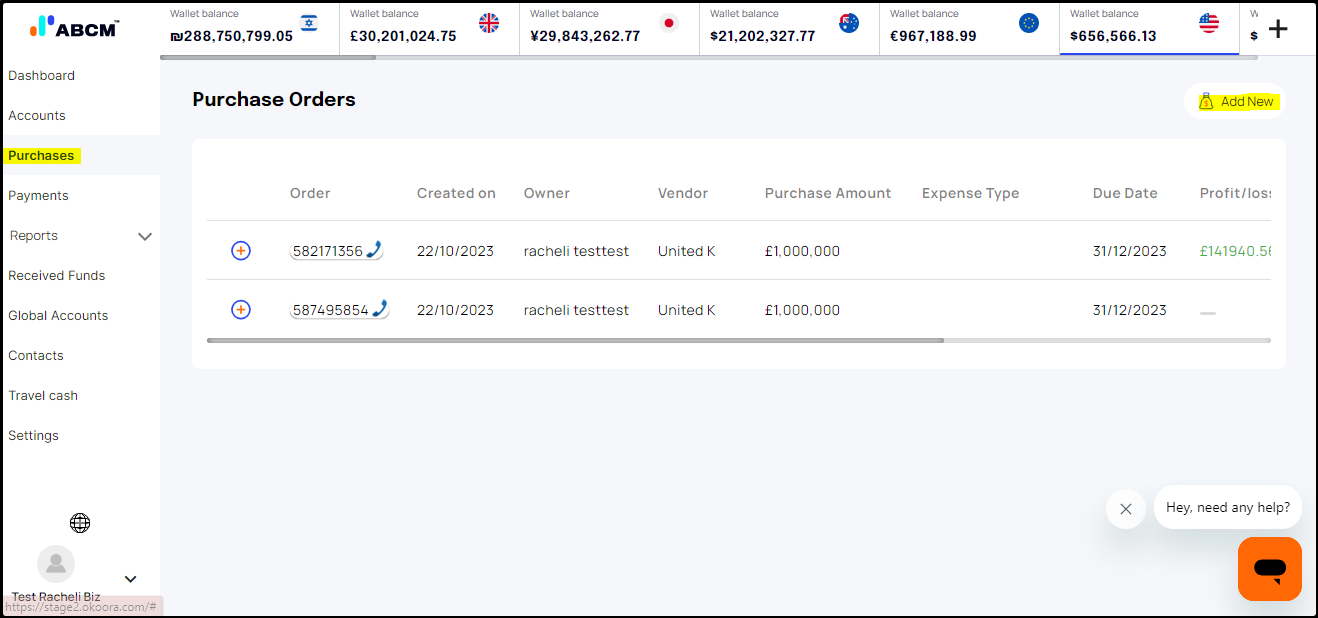

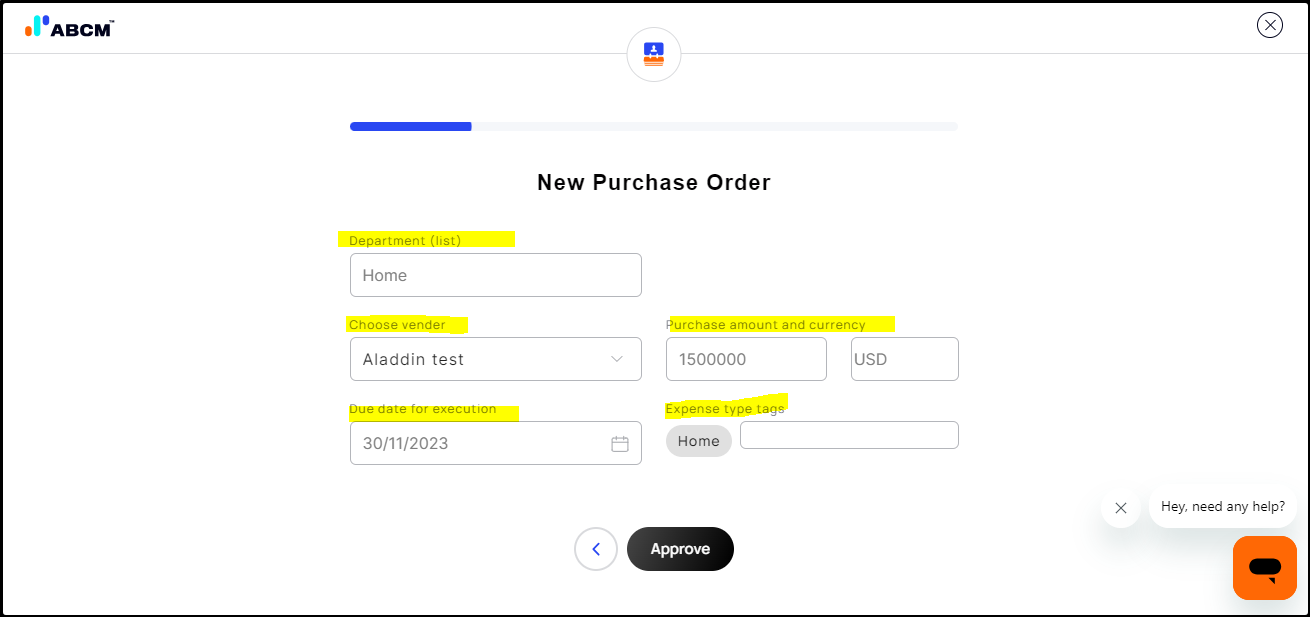

2. Manage your Purchases by clicking on Purchases > Click on "Add New"

Complete all fields and click on "Approve"

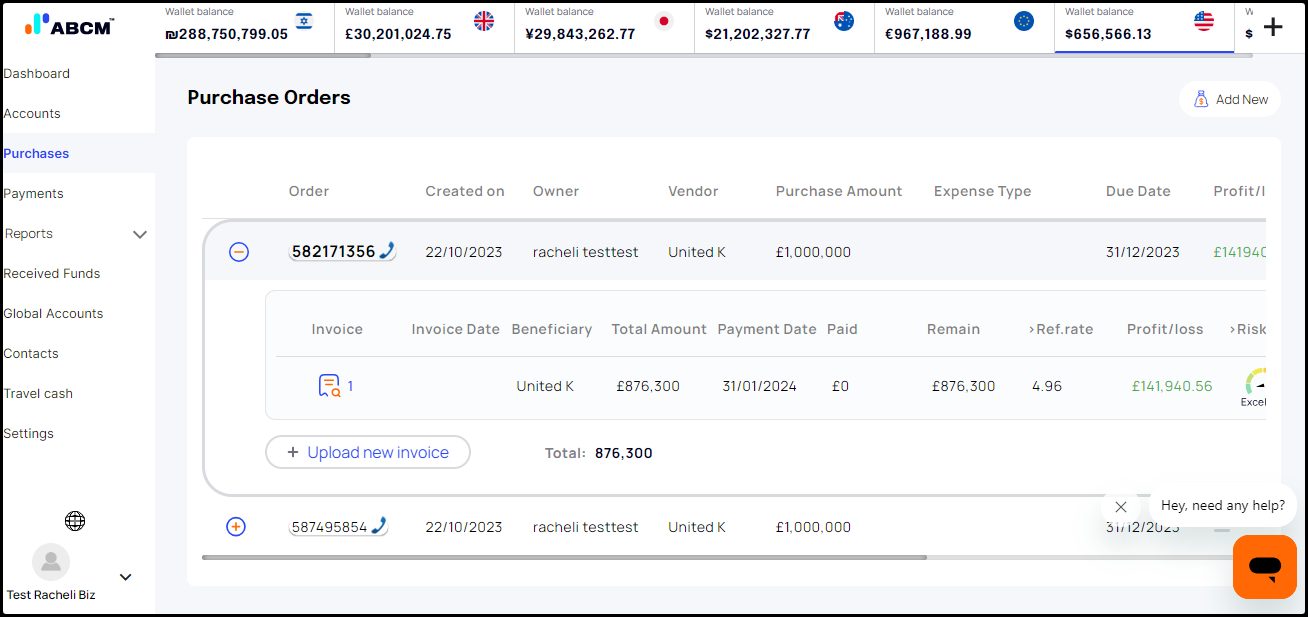

Click on "Upload new invoice" for the same beneficiary.

After setting the purchases, the Dashboard will display the open invoices and their status (At Risk/At Opportunity)

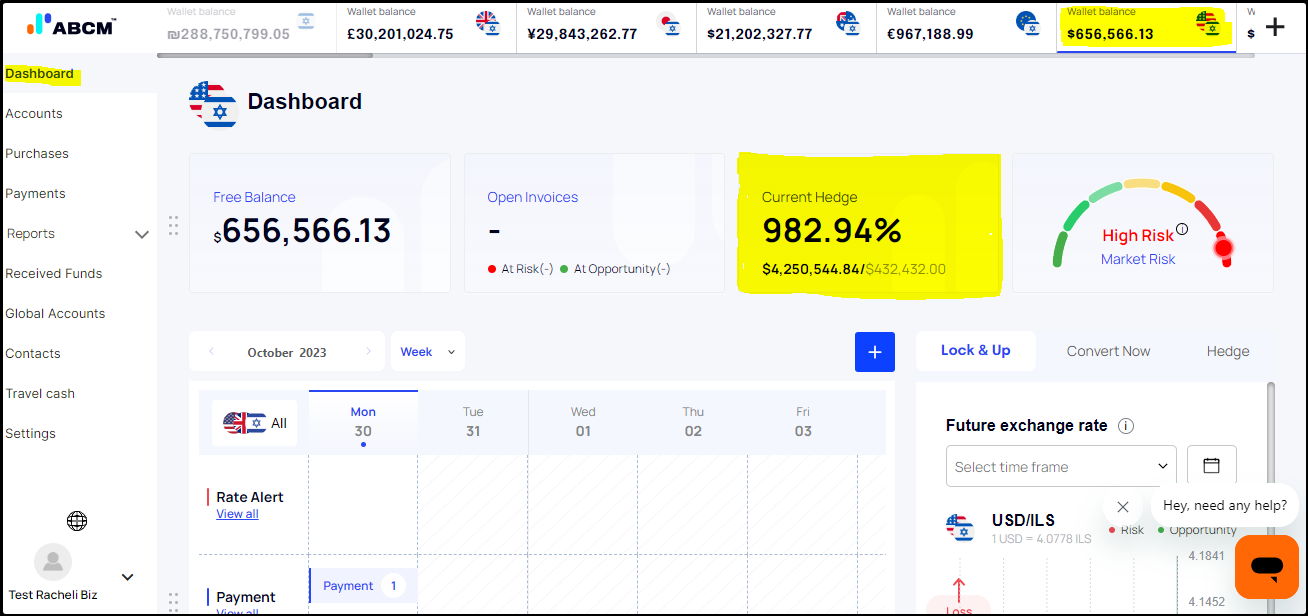

Current Hedge - This tool provides a clear and quantifiable view of the percentage of your business exposure that has been hedged out of all the transactions. By knowing how much of your currency risk is currently protected through hedging, you can assess the business's vulnerability to adverse exchange rate movements and make informed choices about whether to make additional hedging contracts.

In a world where currency markets are in constant flux, the 'current hedge' feature serves as a vital component of businesses' financial strategies, helping them maintain a healthy risk profile while optimizing their foreign exchange operations.

To see the Current Hedge, click on Dashboard > relevant Wallet Balance and you will be displayed with the percentage of hedging made of all the transactions in the selected currency pair.

Market Risk Graph – Displays the market risk level of the selected currency pair. This new tool addresses a pressing need by providing your business with a visual representation of the foreign currency pair market risk exposure over time. By offering a graphical overview of how your currency positions might be affected by market fluctuations, this feature enables businesses to proactively evaluate and respond to potential risks.

It not only enhances financial foresight but also simplifies the complex task of managing market risk, making it an indispensable asset for businesses operating in today's globally interconnected and dynamic business environment. With the help of this feature, you can reduce the negative effects of foreign exchange volatility and safeguard your bottom line by making well-informed hedging decisions.

To see the Market Risk Graph, click on Dashboard > relevant Wallet Balance and you will be displayed with the current market risk of the chosen currency pair.

For more information regarding the latest version of the ABCM platform - visit our blog.