Manage your business activity visually

The foreign exchange market can be overwhelming with vast amounts of data, news, and market events. Many businesses that engage in import or export activities might find it difficult to track multiple operations at once.

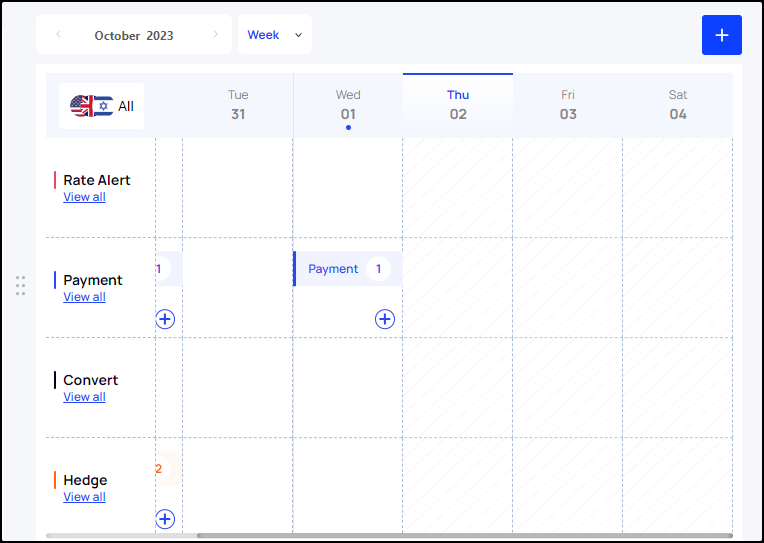

That is why we have created a visual ‘Calendar’ feature in the Dashboard.

Firstly, it provides a user-friendly and organized way to track and manage important financial activities, especially in the context of foreign exchange, making it easier for businesses to digest and act upon.

This visibility will enable your business to respond swiftly to market developments, ensuring you won't miss opportunities or suffer unexpected losses. The 'Calendar' is a powerful tool for businesses operating in the global marketplace where timely actions and meticulous planning are essential for success.

- The 'Calendar' can present a Weekly / Monthly display.

- You can follow the past/future activities set in the calendar by choosing the relevant month.

In this article, we will present the ‘Calendar’ features of the Dashboard that will help you to keep track of the different operations that are set in the ABCM platform.

Rate Alert - The visual calendar can integrate with an alert system, which is invaluable for businesses. You can set an alert in each currency pair of your choosing that will notify you when the market reaches the Target Rate you have set. This will allow you to continue your business activity without the need to constantly keep track of the foreign exchange market.

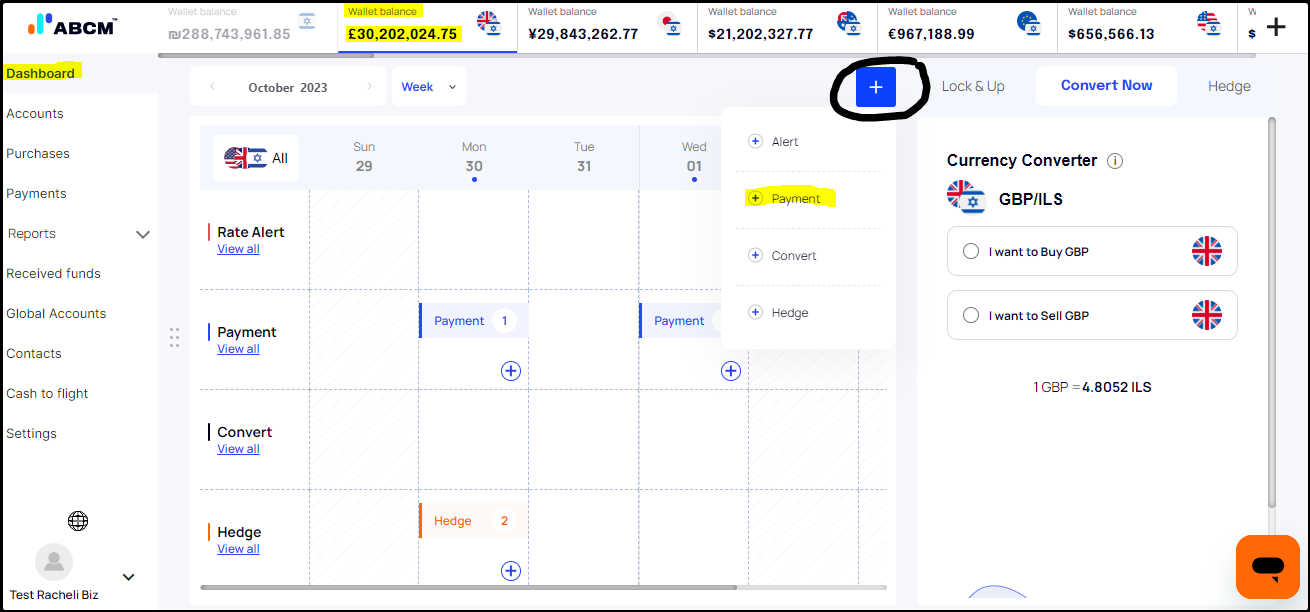

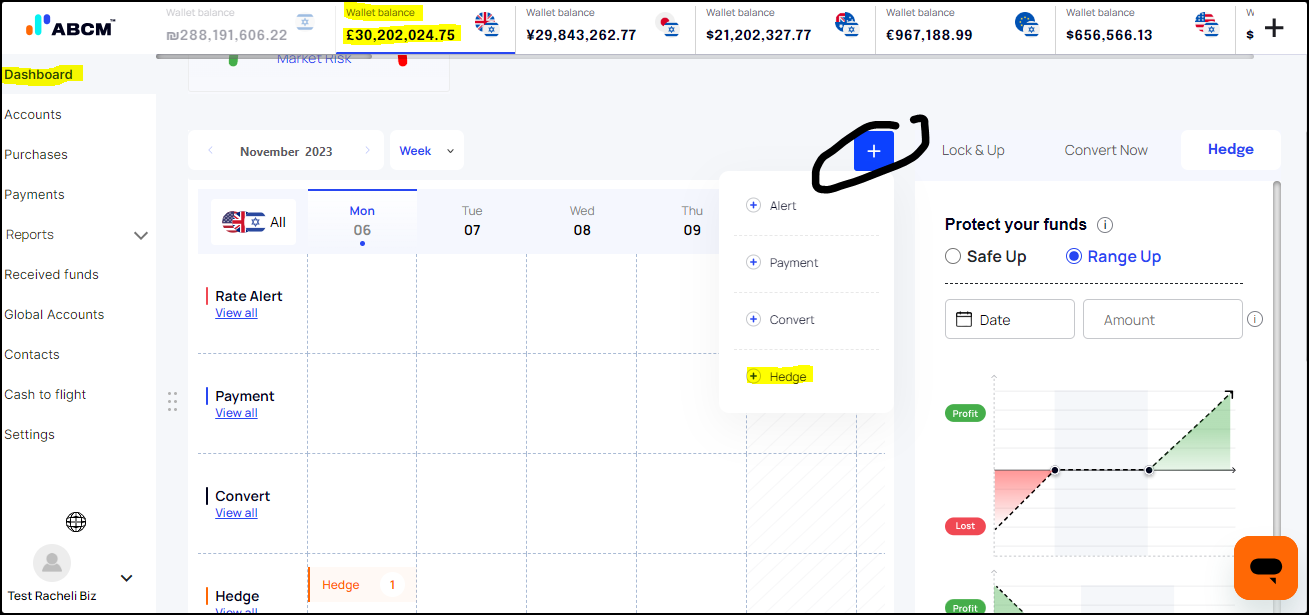

To set up the Rate Alert, click on Dashboard > relevant Wallet Balance > ‘+’ sign > Alert > choose the Target Rate and Alert Expiry Date > click on Create an alert.

Payment - For companies involved in international trade, having a visual calendar that highlights payment deadlines for imports and exports is crucial. Missing these dates can result in financial penalties, damaged relationships with trading partners, or disrupted supply chains. The calendar helps businesses stay on top of their obligations and ensure on-time transactions.

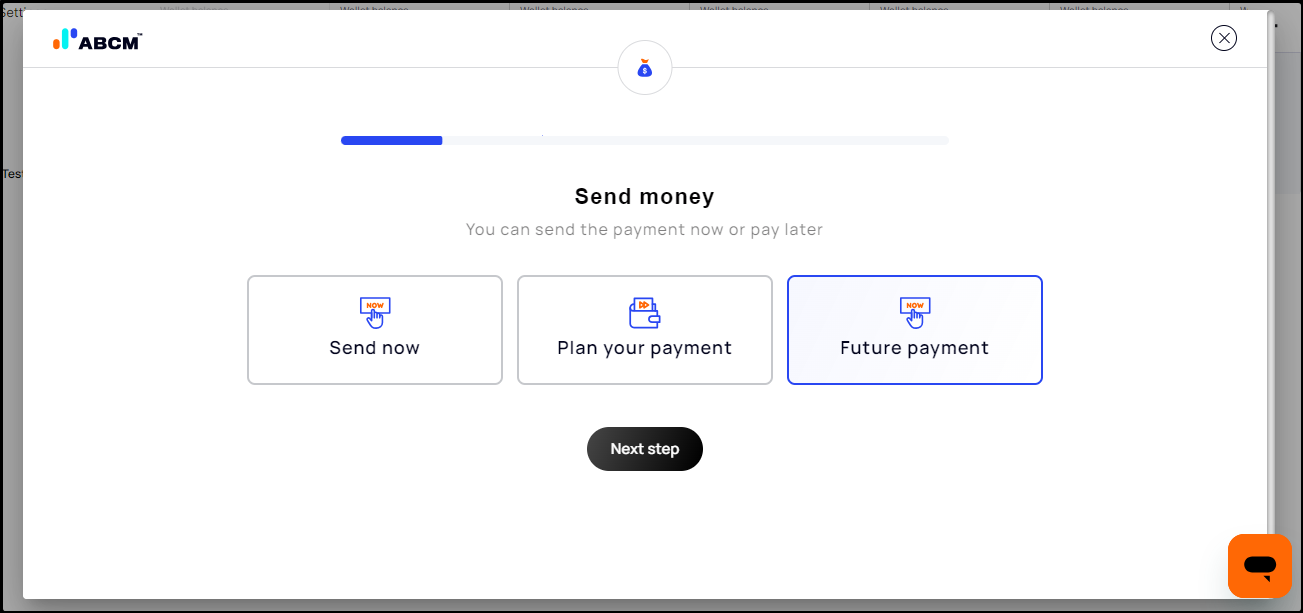

You can make 3 types of payments:

1. Current payment – to send a payment now, the same way as you do it through the ‘Account’

2. Plan your payment – to set a target rate and date for the payment

3. Future Payment – to lock the current rate and to pay it later (will lock the available amount)

To set a Payment, click on Dashboard > relevant Wallet Balance > ‘+’ sign > Payment

Choose the payment type > proceed as instructed

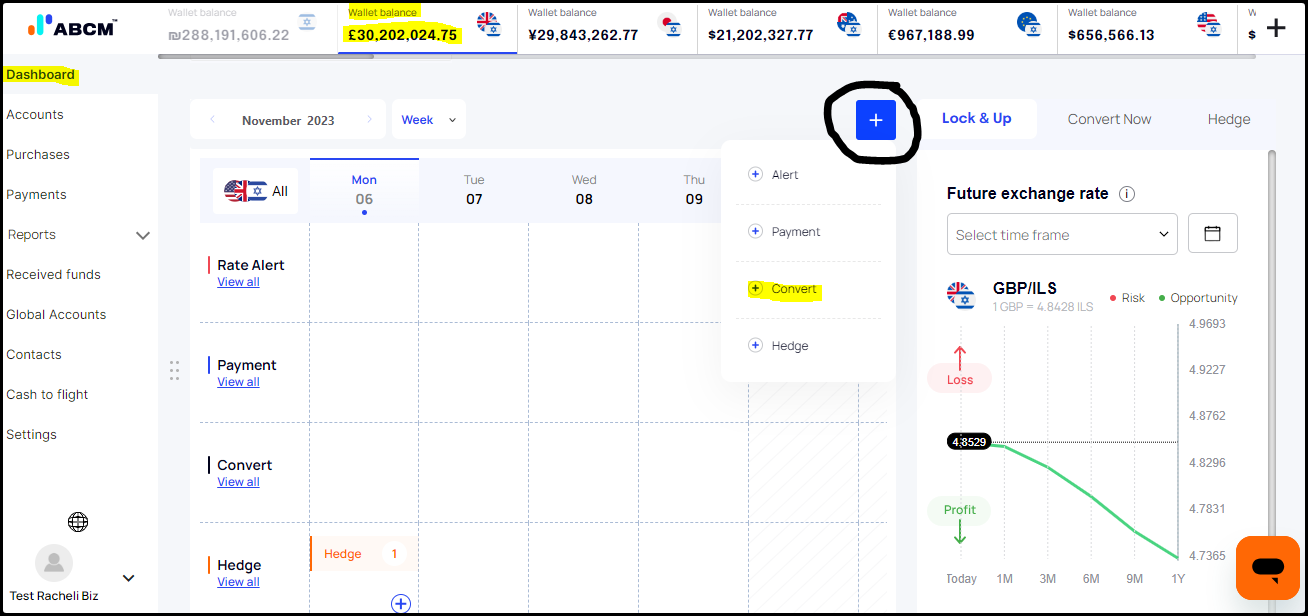

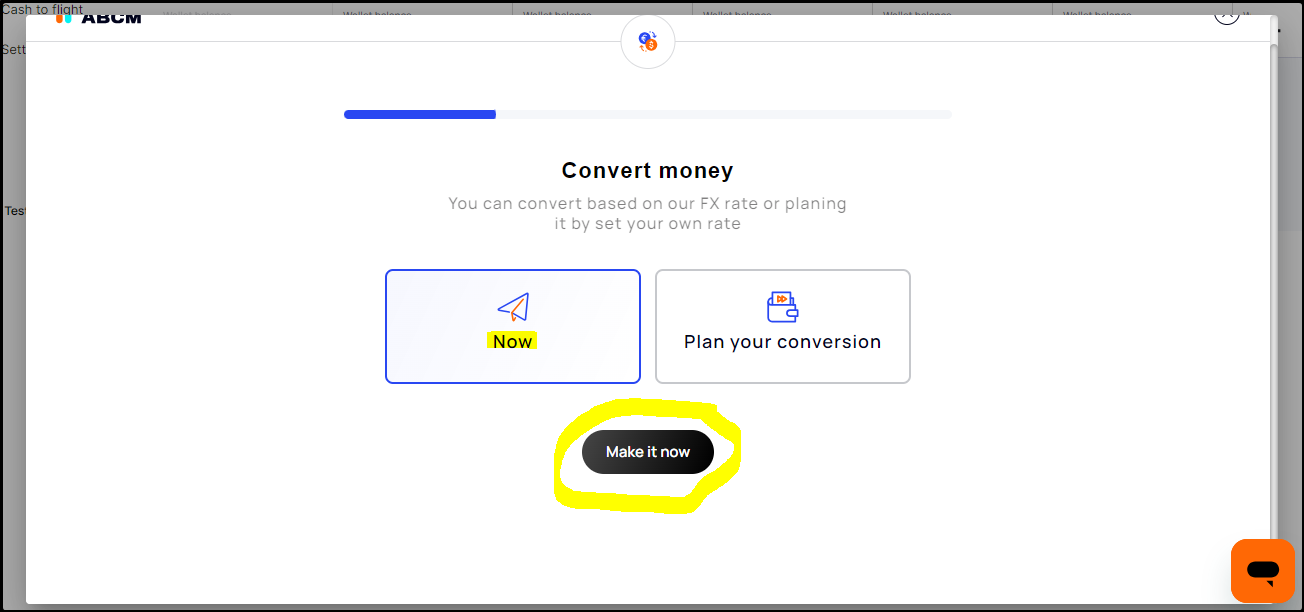

Convert – Having the ability to convert specific currency pairs 'Now' / 'Plan your conversion' allows you to make a calculated conversion depending on the market situation.

If you want to “catch” the market at its current foreign exchange rate, you should convert now and use the balance in the future for necessary transactions.

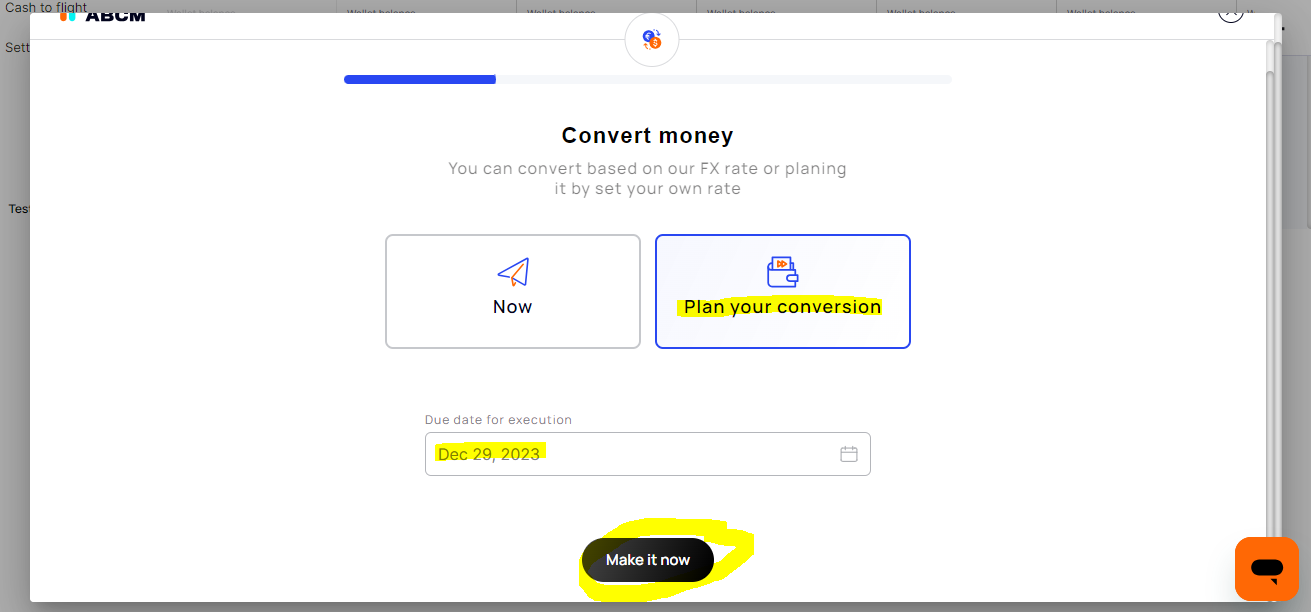

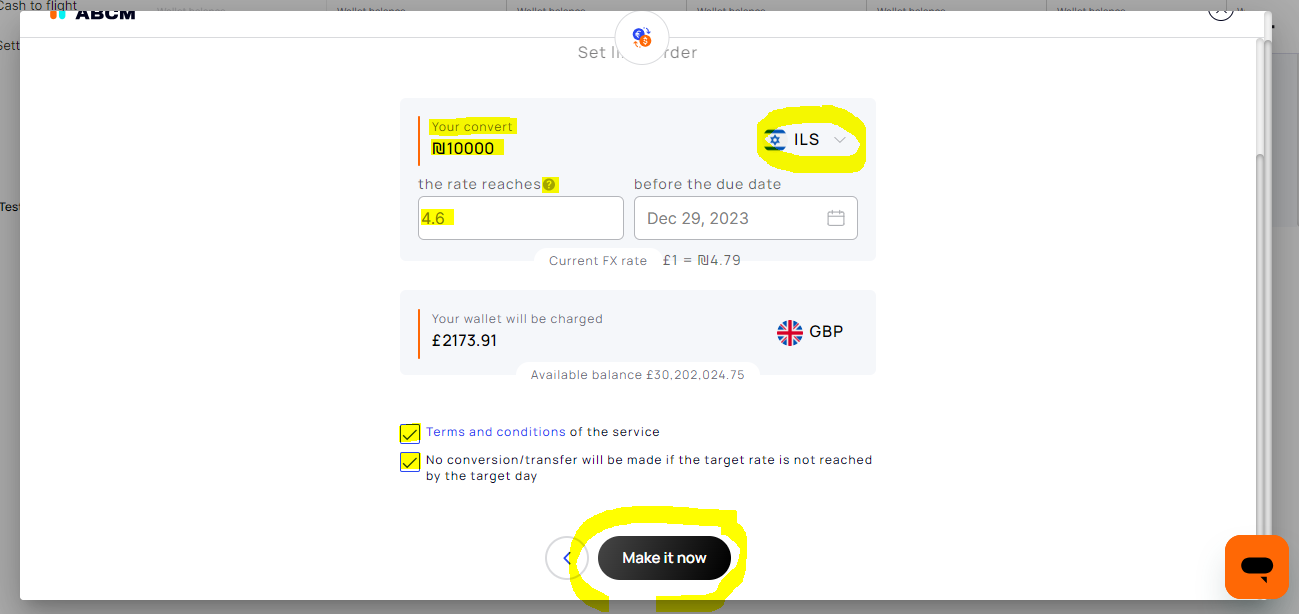

If you don’t have any necessary payments or transfers to make, you can plan your conversion and choose a due date and target rate.

- Please notice - No conversion/transfer will be made if the target rate is not reached by the target day

- To complete the transaction, the required amount must be available in the wallet.

To Convert, click on Dashboard > relevant Wallet Balance > ‘+’ sign > Convert > choose "Now" or "Plan your conversion" > click make it now

If you choose to Plan your conversion – choose the conversion’s due date > Make it now

Write the target rate and conversion amount > check both boxes at the bottom > click Make it now.

Hedging - A calendar is indispensable for managing hedging and currency conversion activities. It allows your business to schedule these actions strategically, aligning them with market conditions that favor your financial goals. It also ensures that currency risks are addressed proactively, which will help you to protect your company’s profit margins.

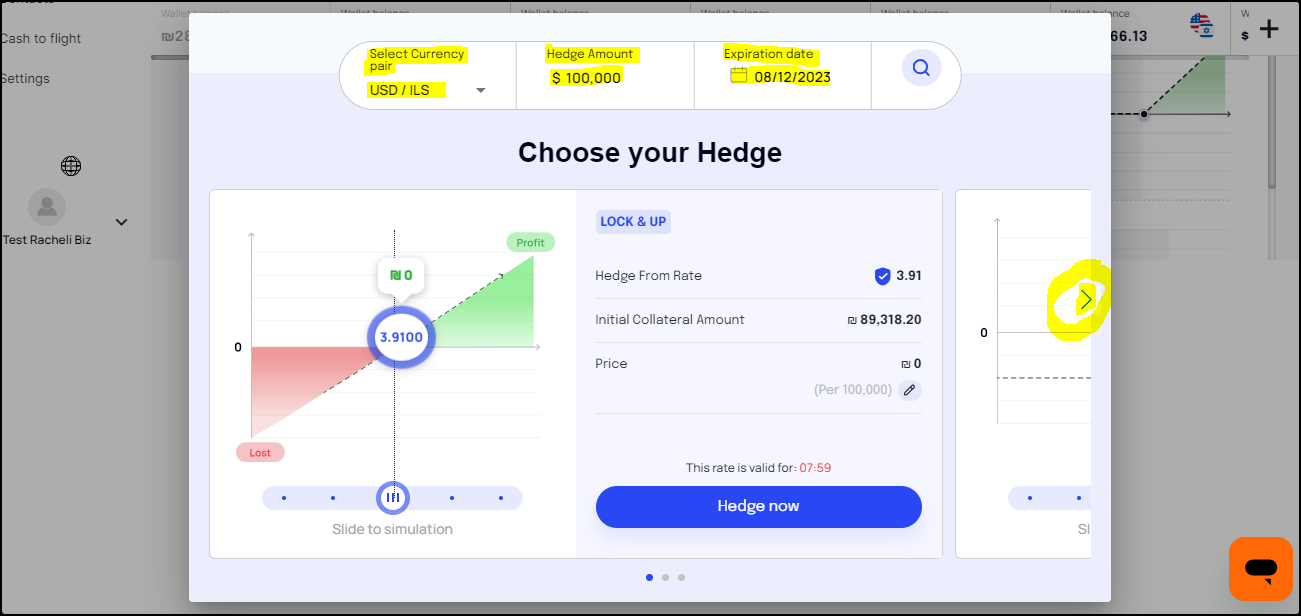

When clicking on ‘Hedge’ in the calendar, you will be presented with all the different hedging options that you currently have due to the current market situation:

- Lock & Up/Down - This feature empowers businesses to lock in exchange rates for future transactions, providing a valuable tool to hedge against the uncertainties of currency markets.

- Safe Up/Down - Hedges involve setting a specific exchange target rate, allowing your business to lock in a rate that you consider favorable, either above or below the current market rate.

Apart from the required premium, this hedging has no risk of loss

- Range up/down - Hedges that allow your business to specify a range within which they are comfortable with the exchange rate fluctuation.

To set a Hedging, click on Dashboard > relevant Wallet Balance > ‘+’ sign > Hedge

Select currency pair + hedge amount + expiration date > choose your hedge > proceed as instructed

For more information regarding the latest version of the ABCM platform visit our Blog.