Discover our new Quick Action Panel in the Dashboard

In today's ever-changing world, many companies are jeopardizing their company’s profit line due to high volatility in foreign currencies. It is impossible to overlook the intermediate product—foreign currency—when a company is involved in import or export activity. For this reason, it is crucial to take the appropriate actions to avoid unnecessary expenses that could result from market volatility.

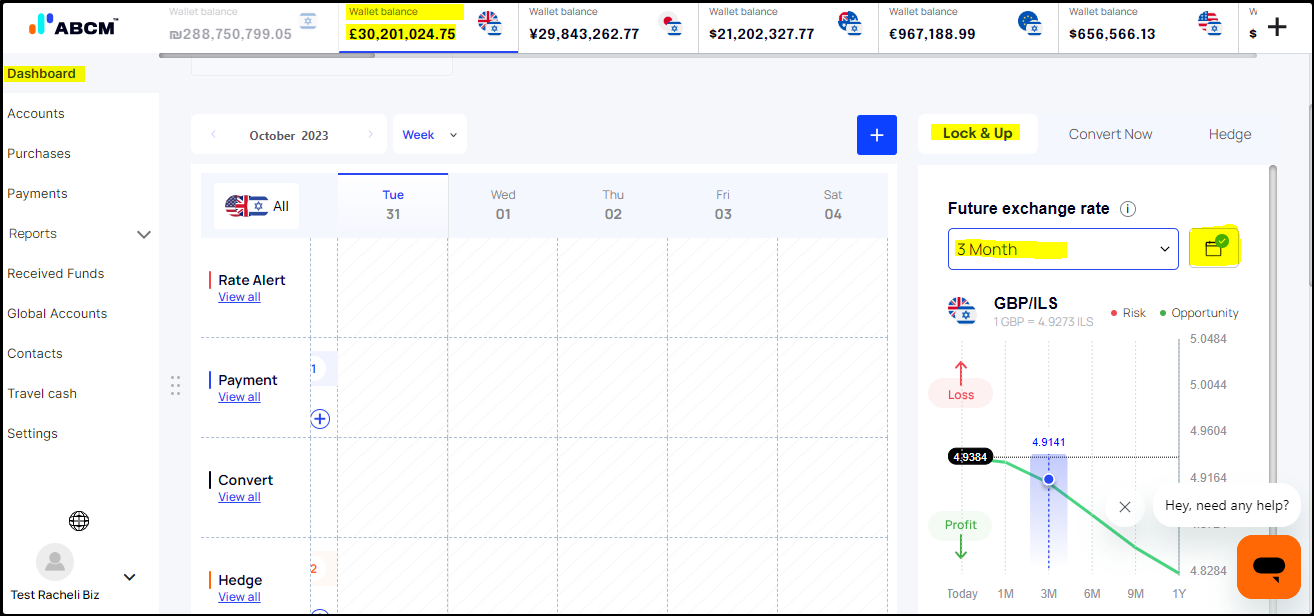

Given the current uncertainty of the FX market, we recognized the need of our business customers for the consolidation of instant operations all into one place. That is why we created the dashboard which enables quick and simple access to every system function.

This article is part of a series detailing and demonstrating the outstanding features of the new dashboard.

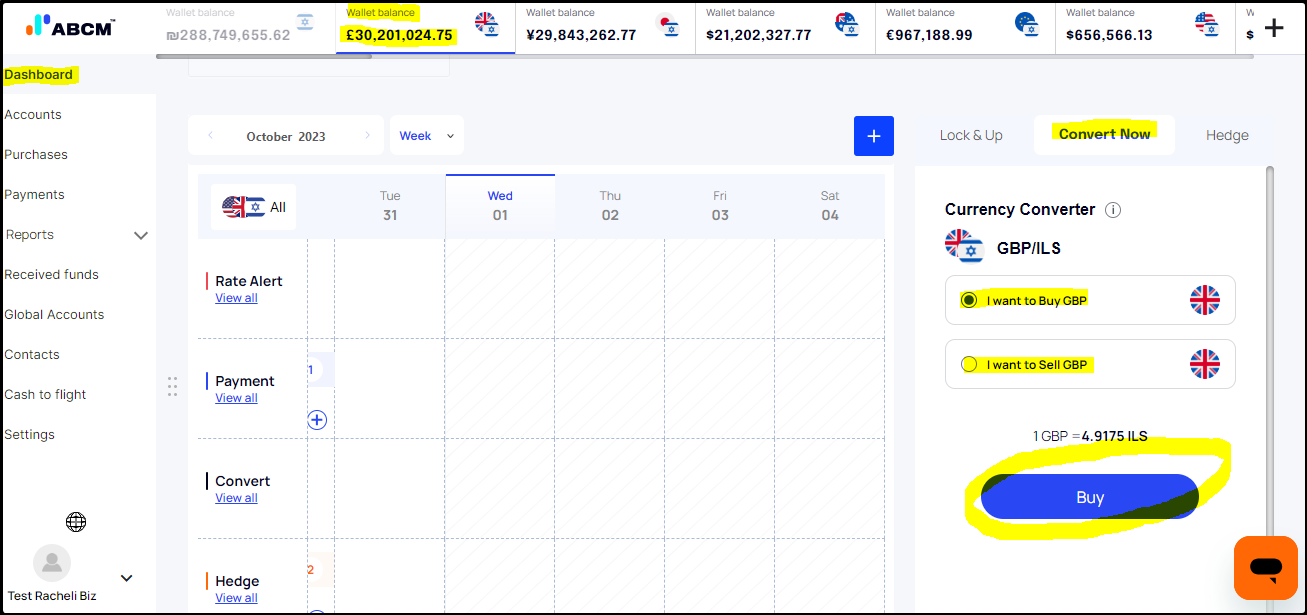

The quick actions panel allows you to perform an immediate conversion, lock the current conversion rate for a selected period, and protect your funds by purchasing currency insurance.

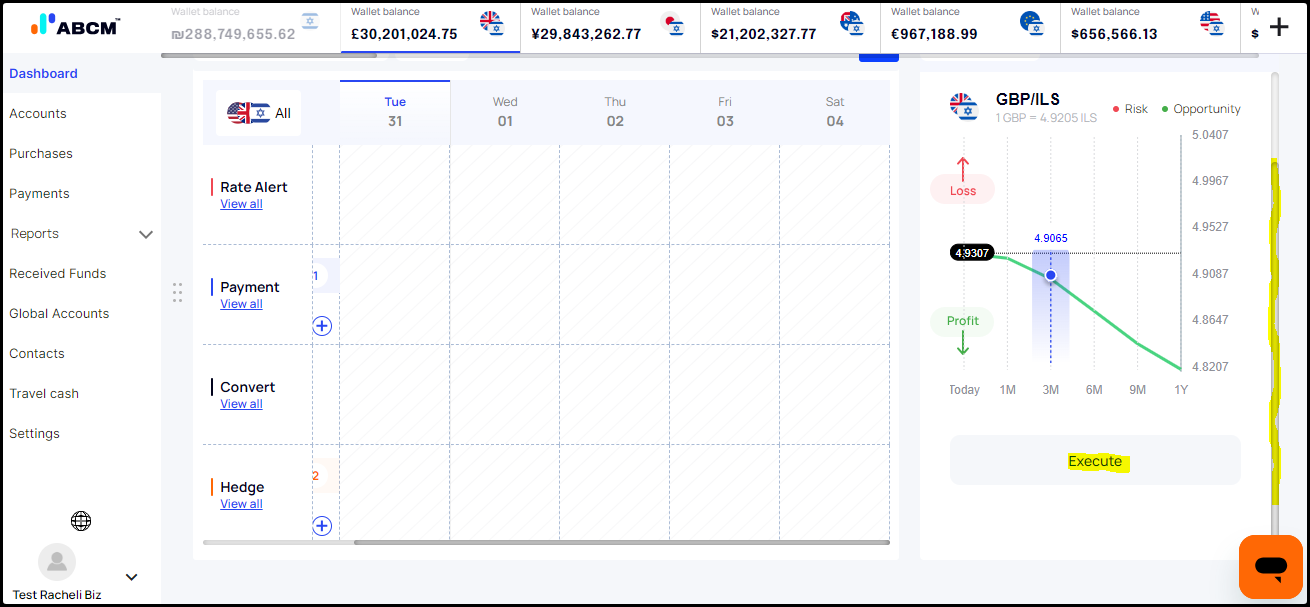

Lock & Up/Down – This feature empowers businesses to lock in exchange rates for future transactions, providing a valuable tool to hedge against the uncertainties of currency markets. By utilizing Forex's future, you can make business plans with confidence, safeguard profit margins, and ensure financial stability in a volatile global economy.

To lock the current exchange rate, click on Dashboard > relevant Wallet Balance > Lock & Up > select time frame/specific time using the Calander > click on Execute

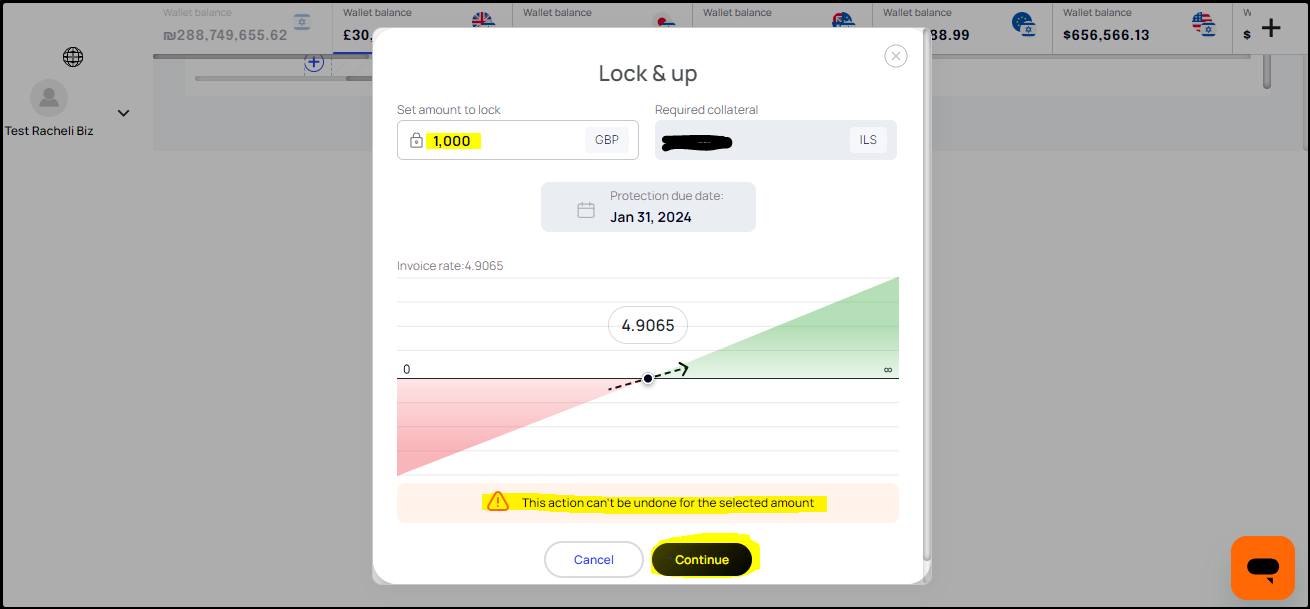

After choosing Execute you will have a pop-up window to set the amount to lock. After setting, click on "Continue".

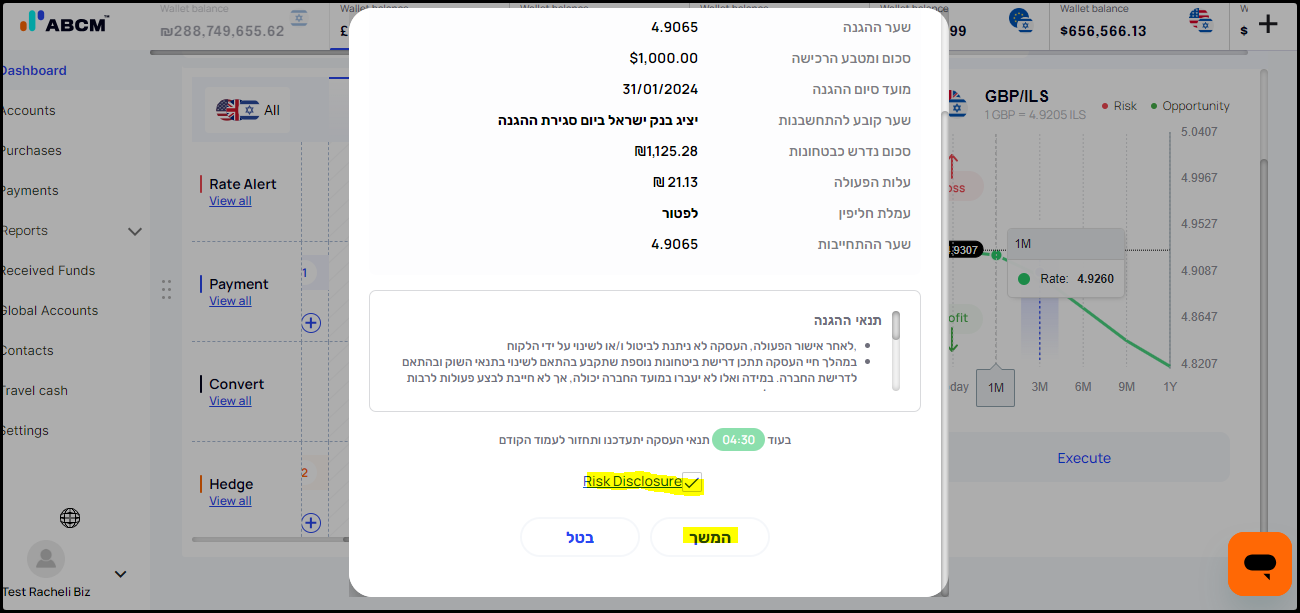

Then, verify the information and approve the "Risk Disclosure"

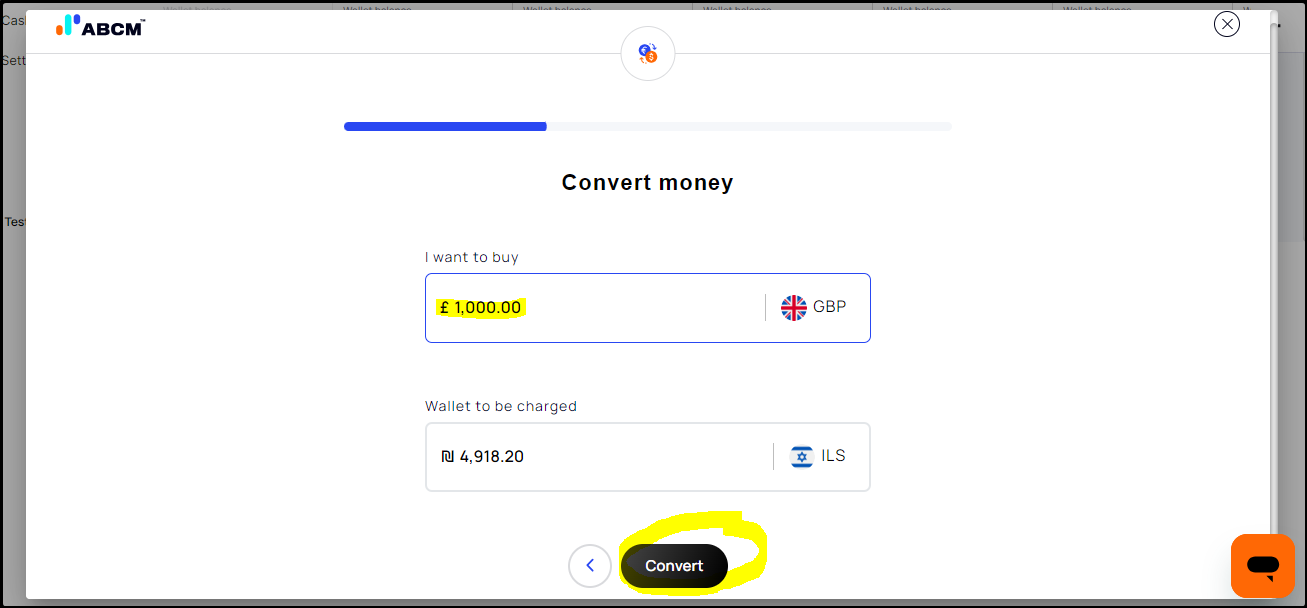

Convert Now - a powerful tool that allows you to instantly convert one currency into another at the prevailing exchange rate. By offering real-time conversion capabilities, "Convert Now" minimizes exposure to currency risk and enables your business to make timely financial decisions, enhancing your business's ability to optimize international trade and financial operations.

To make a quick conversion, click on Dashboard > Relevant Wallet Balance > Convert now > choose if you want to buy/sell and click on the blue button - "Buy"

Enter the amount you want to buy/sell > click on "Convert" > verify and approve the conversion and click on ‘make it now’.

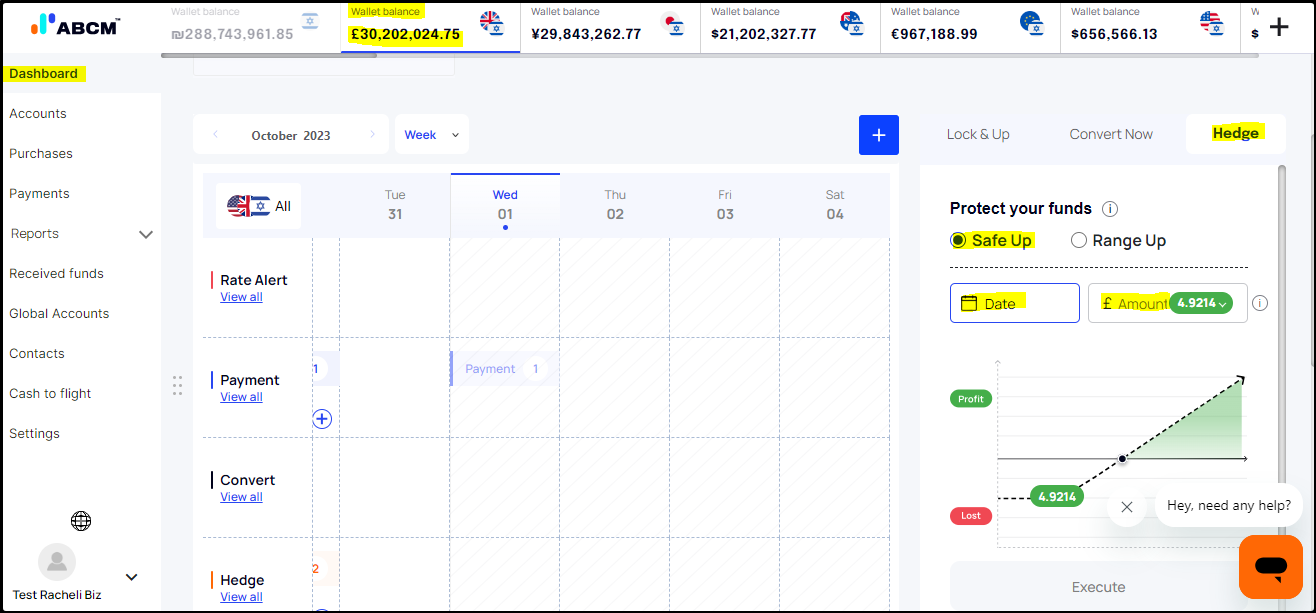

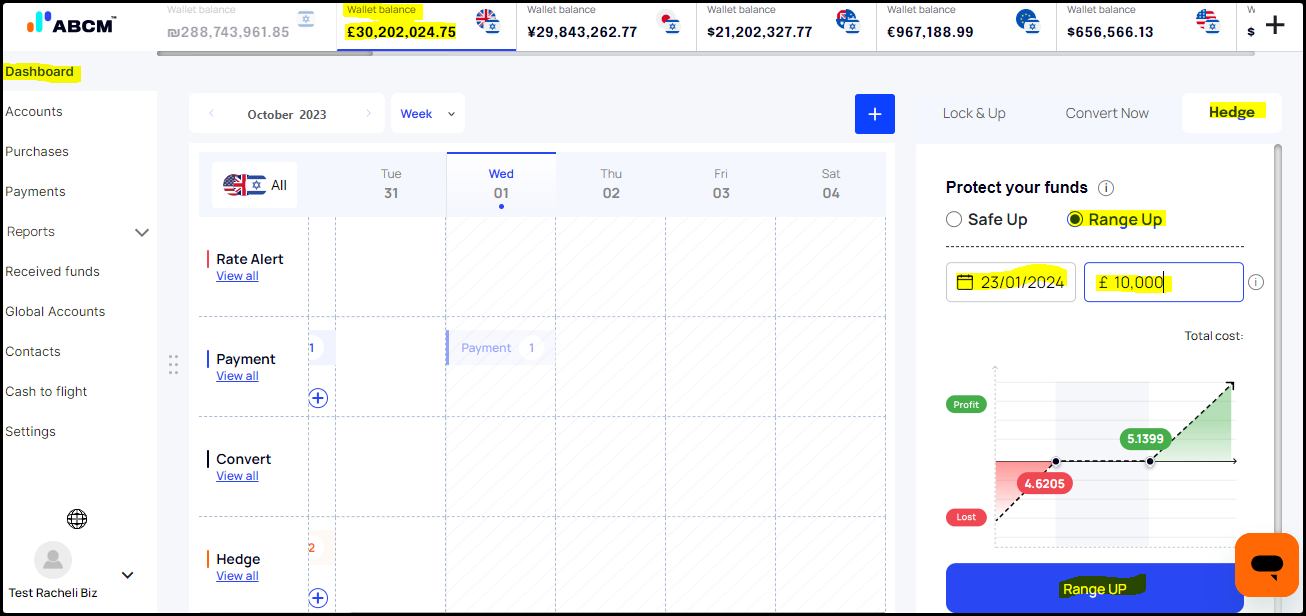

Hedge – a critical tool that addresses the essential need for risk management in this field of international trade and financial operations. It ensures profit margin protection by eliminating the uncertainty associated with fluctuating exchange rates

To mitigate this risk, the "Hedge" tool empowers your company to proactively manage your currency exposure by entering hedging contracts. This feature will allow your business to lock in exchange rates for future transactions, providing a much-needed level of predictability in an otherwise uncertain financial landscape.

This feature provides two distinct hedging options:

Safe up/down - Hedges involve setting a specific exchange target rate, allowing your business to lock in a rate that you consider favorable, compared to the current exchange rate. This type of hedge can only benefit you as it serves as insurance that protects your funds.

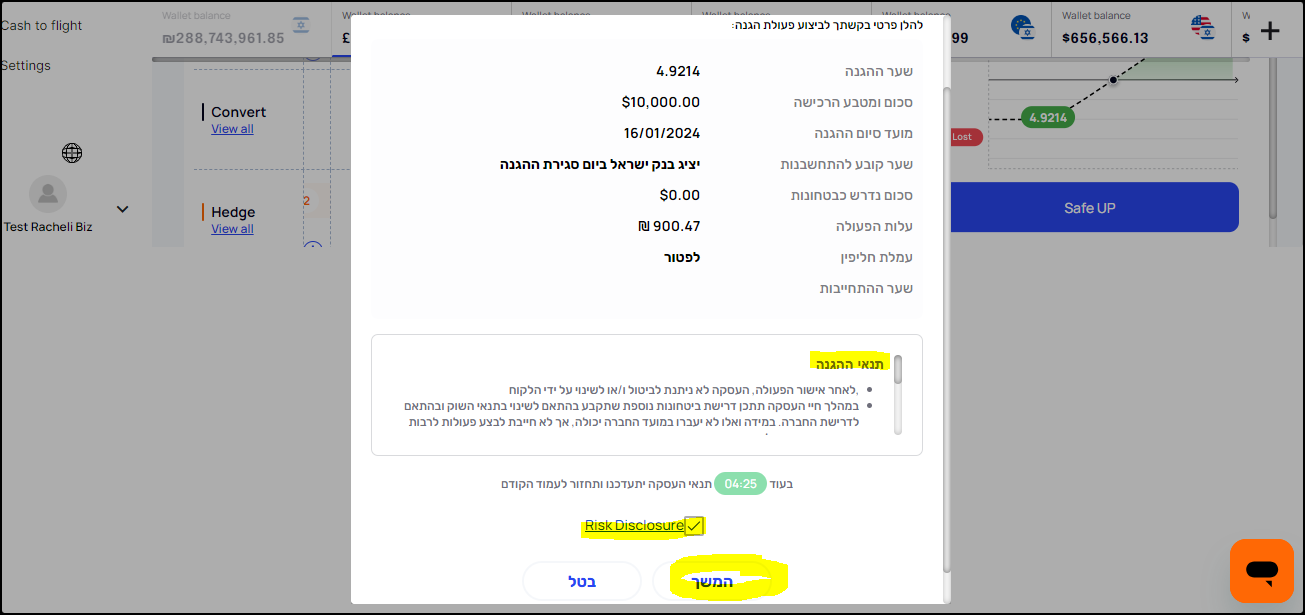

To Protect your funds, click on Dashboard > relevant Wallet Balance > Hedge Tab > choose Safe Up/Down > choose the execution date & amount & preferable spread > click on ‘Safe up/down’

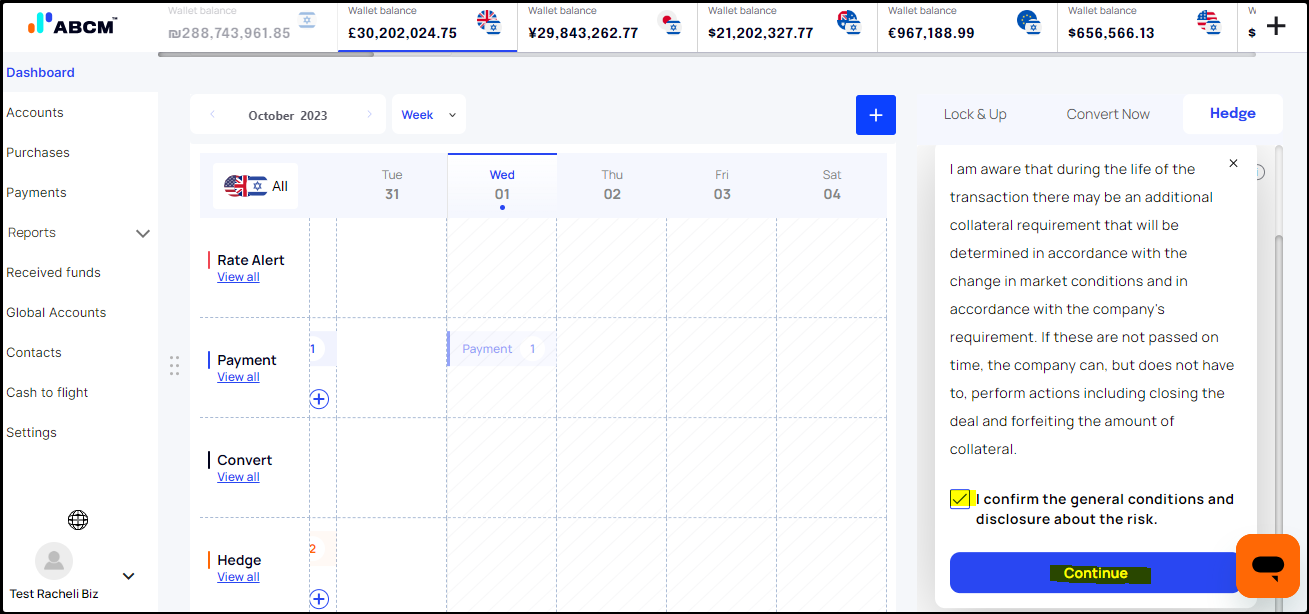

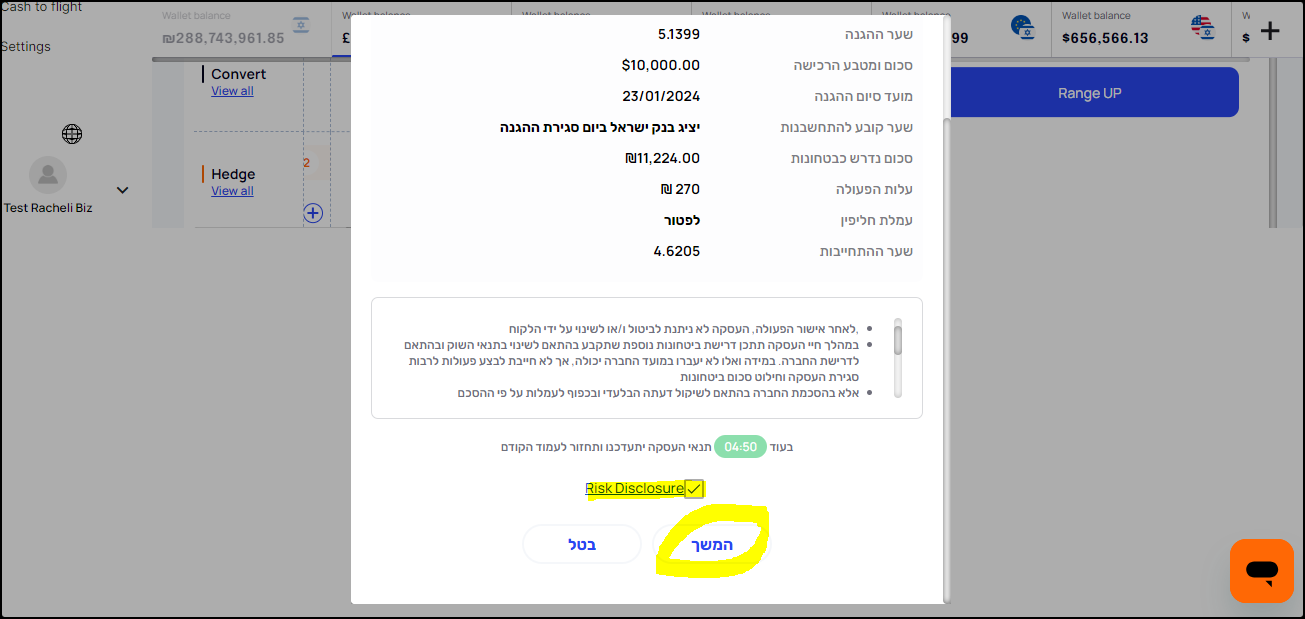

Verify and approve the ‘risk disclosure’ and click on ‘continue’ to submit.

Range up/down - Hedges that allow your business to specify a range within which they are comfortable with the exchange rate fluctuation. This type of hedge is more flexible as it protects against rate movements that fall outside the specified range, while still allowing potential gains if rates stay within the defined bounds.

The choice between these two types of hedges depends on your business’s risk tolerance, market outlook, and financial goals, offering a tailored approach to risk management.

To Protect your funds, click on Dashboard > Relevant Wallet Balance > Hedge > Choose Range up/down > Choose the execution date & amount > Click on 'Range Up/Down’.

Confirm the general conditions and disclosure.

Verify and approve the ‘risk disclosure’ and click on ‘continue’ to submit.

For more information regarding the latest version of the ABCM - visit our blog.